Text size

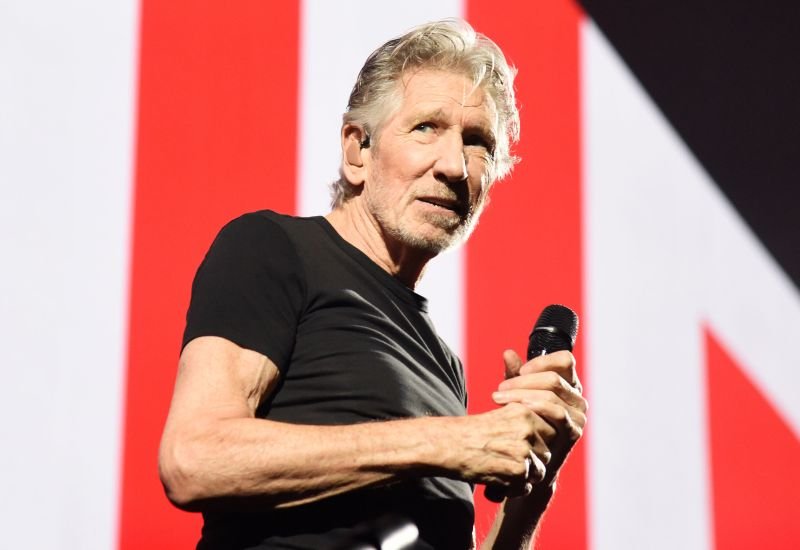

JPMorgan Chase CEO Jamie Dimon.

Michel Euler/Pool/AFP/Getty Images

JPMorgan Chase

CEO Jamie Dimon told President Biden at a Monday meeting that the United States needs a “Marshall Plan” for energy.

The two spoke at a meeting attended by executives from large US energy companies like

Exxon Mobil

(ticker: XOM) and financial firms. The Marshall Plan was an enormous government program intended to help Western Europe rebuild from World War II. Dimon’s new idea for a Marshall Plan would focus specifically on energy in order to keep Russia’s invasion of Ukraine from destabilizing energy markets.

There were four parts to the plan, according to a source familiar with Dimon’s statement, which was first reported by Axios.

First, Dimon thinks the US should work on increasing its natural gas production capacity, to have more gas to send to Europe and replace Russian supplies.

Second, the US needs to encourage Europe to expand its own liquefied natural gas facilities—an idea that is already moving forward in Germany, which has announced that it’s building two new “re-gasification” facilities to accept gas from overseas and transform it back into usable fuel.

Third, Dimon thinks the US needs to invest more rapidly in energy sources like hydrogen and carbon capture technologies.

And lastly, Dimon proposed speeding up the process for installing renewable energy, including by reducing permitting times.

Each aspect of Dimon’s idea has been floated before, without the rhetorical wrapping of a Marshall Plan. In that sense it’s old wine in new bottles. But it puts a spotlight on the current debate over US energy policy.

The US is a key player in the global energy market, producing more oil and gas than any other country. Russia’s invasion and the subsequent sanctions have caused oil and gas prices to spike, because Russia is also a top energy producer. Biden has said that oil producers have the land and tools they need to produce more, though some oil executives have said that the administration should do more to give the industry the regulatory backing and support for infrastructure like pipelines.

Dimon, the longest-running chief executive at a major US bank, often discusses larger economic issues and his name in the past has even been floated as a potential Treasury Secretary. His energy proposal could be read as another big idea in the same vein of his previous pronouncements on saving capitalism.

JPMorgan (JPM), however, is also undoubtedly in a position to benefit if spending on fossil fuel production and transportation increases, and if more renewable energy proposals get the green light. The bank is the largest lender to fossil fuel companies in the country, though it has been phasing out some kinds of lending, including to coal companies. It’s also the largest backer of green bonds in the country, and gets more fixed income revenue than any other bank from projects using the environmental social and governance (ESG) investment model.

JPMorgan declined to comment on Dimon’s statements or criticism of the bank’s fossil fuel investments. A spokesman also did not have a comment on whether Dimon supports Biden’s Build Back Better bill, which would create incentives for several of the industries included in Dimon’s proposal.

The White House did not respond to a request for comment about whether it supports Dimon’s idea.

Write to Avi Salzman at avi.salzman@barrons.com

0