K-pop girl group BlackPink performed on The Late Late Show with James Corden airing Thursday, April 18, 2019. (Photo by Terence Patrick/CBS via Getty Images)

Cbs Photo Archive | cbs | Getty Images

The creator behind the new exchange-traded fund aimed at converting global fans of Korean content into an investment opportunity is optimistic in its premise.

Since its launch on September 1, the KPOP and Korean Entertainment ETFs hasn’t performed well – recently trading on the New York Stock Exchange Arca at $15.05 – down about 23% since its debut. This corresponds to the fact that the global Kospi index has fallen by more than 20% this year.

But Jangwon Lee, managing director of CT Investments and Contents Technologies and creator of the ETF, is optimistic about Korea’s entertainment industry despite the lackluster outlook for global markets.

“Consumption of content, especially digital, is relatively resilient in recessionary and inflationary and longer-term environments,” Lee said in an interview with CNBC, adding, “It’s been a tough few weeks across all asset classes. ” since the creation of the fund.

Shares of Korean entertainment companies have underperformed overall, with YG Entertainment’s share price down about 26% year-to-date and Hybe down more than 64% year-to-date. year.

“Ultimately we believe that the underlying performance of our ETF companies will provide further momentum to attract demand from a broader universe of investors,” he said.

We are witnessing an inflection point in K-pop and K content gradually reaching mainstream status globally from what was more of a subculture in the past.

Jangwon Lee

CEO of CT Investments

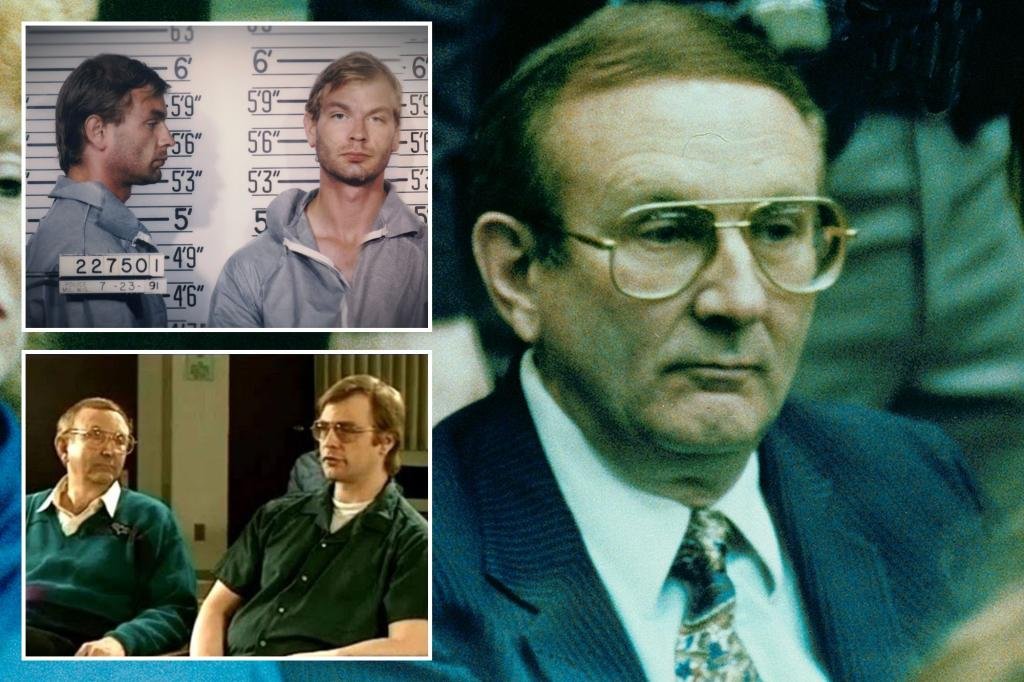

The KPOP ETF states on its website that it provides “targeted exposure to Korea Exchange-listed companies engaged in the entertainment industry and the interactive media and services industry.” The fund is an index of 30 stocks, which includes entertainment companies that manage groups such as BTS, BlackPink and Twice – their respective agencies being HYBE, YG Entertainment and SM Entertainment.

It also includes content creators such as Studio Dragon, which produced the hit series “Crash Landing on You” and platform companies such as AfreecaTV, through which some broadcast themselves by playing games. video games and eating.

“We believe it is still in its infancy as we are witnessing an inflection point in K-pop and K content gradually reaching mainstream status globally from of what was more of a subculture in the past,” he said.

JYP Entertainment’s K-pop girl group Twice at Yes24 Live Hall on April 22, 2019 in Seoul, South Korea. Shares of Korean entertainment companies underperformed overall.

Jtbc More | imaginings | Getty Images

Pent-up request

Lee of CT Investments and Contents Technologies said the creative content companies this fund makes accessible to global investors will thrive in the longer term, with borders reopening and countries like South Korea and Japan lifting quarantine rules. and testing for tourists.

“There is significant pent-up demand among existing fans, and K-pop artists have deliberately released new albums in time for the reopening,” he said, adding that many artist groups have recently resumed. their world tours and concerts.

Financial analyst Lee Ki-hoon of Hana Financial Group said the pandemic proves the genre is benefiting from its music business being more “visual concept” oriented, as seen in its social media spread.

“His global fandom sees a ripple effect from bands like BTS and BlackPink, as they were direct beneficiaries of YouTube – he’s not limited by time or place,” Lee Ki-hoon said in a report. ‘october.

BangtanTV, one of BTS’ YouTube channels, has 71.5 million subscribers, while BlackPink’s channel has 82.7 million subscribers.

BTS performs onstage during the 64th Annual GRAMMY Awards at MGM Grand Garden Arena on April 3, 2022 in Las Vegas, Nevada.

Johnny Nunez | Getty Images Entertainment | Getty Images

“Longtime Believer”

Goldman Sachs predicts global music industry revenues will hit $131 billion by 2030, more than double the $62 billion in 2017, adding that streaming will propel the industry to record highs.

CT’s Jangwon Lee is also optimistic, adding that he is a “long-term believer” in K-pop’s prospects within the wider industry.

“K-pop fan engagement across the globe is significantly higher than that of other genres across metrics, such as social media engagement and merchandise sales, including album sales. physical,” Lee said.

“We think there could be a strong conversion among fans becoming shareholders of companies their favorite artists are affiliated with,” he said.

In the shorter term, Hana Financial Group’s Lee said Hybe, the group behind BTS, may bottom out around December, when the group’s plans to enlist in the South Korean military will be finalized.

CT’s Lee said the agency’s confirmation that the band will move forward with its conscription plans means removing some uncertainty.

“A significant surplus has been removed,” Lee said, adding that investors’ attention will now “shift to other growth prospects across its business.”

0