Broadcom Inc.

Broadcom Inc.

AVGO

$7.74

1.28%

32%

IBD Stock Analysis

- Stock has been consolidating for 11 weeks with buy point of 677.86

- Analysis shows early entry available at 614.74 if it passes recent high

- Chipmaker forecasts accelerating sales growth for the current quarter

![]()

Industry Group Ranking

![]()

Emerging Pattern

![]()

Consolidation

* Not real-time data. All data shown was captured at 12:57PM EDT on 03/18/2022.

Broadcom (AVGO) is the IBD Stock Of The Day as it sets up multiple buy points following the recent stock market correction. AVGO stock pink on Friday.

X

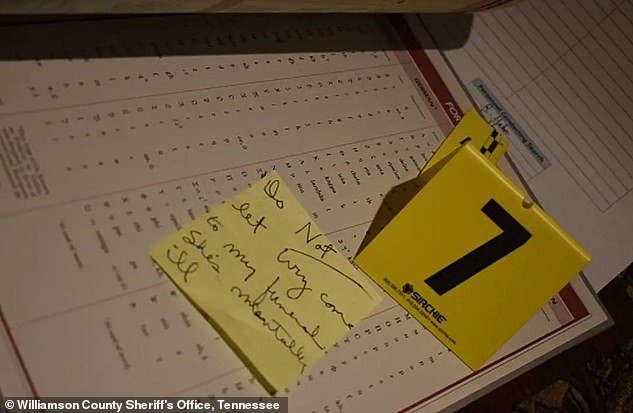

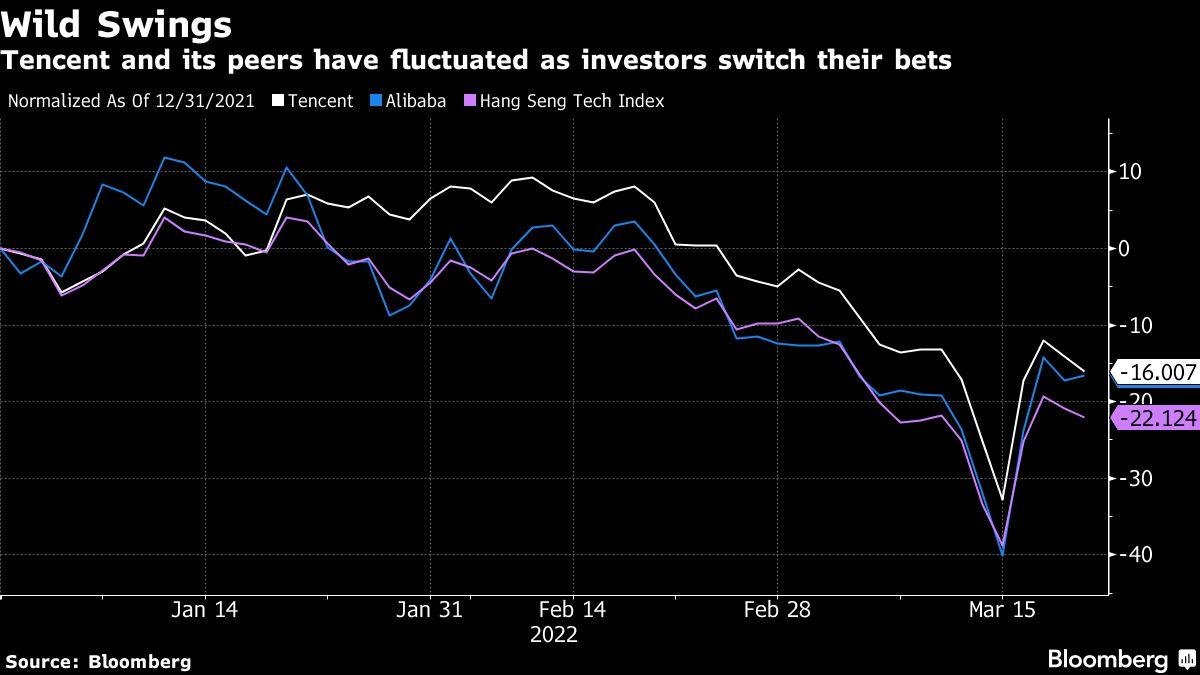

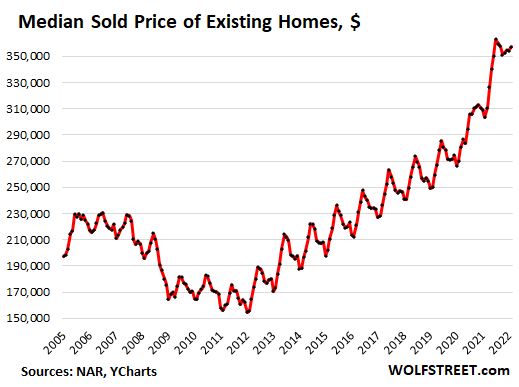

Broadcom stock has been trending sideways since its earnings report on March 3. AVGO stock has been consolidating for the past 11 weeks and has a buy point of 677.86, according to IBD MarketSmith charts.

That official buy point is 10 cents above the all-time high for AVGO stock of 677.76, reached on Dec. 28. However, IBD analysis points to a possible early-entry buy point of 614.74, if it surpasses a recent high.

On the stock market today, AVGO stock rose 1.3% to close at 610.41.

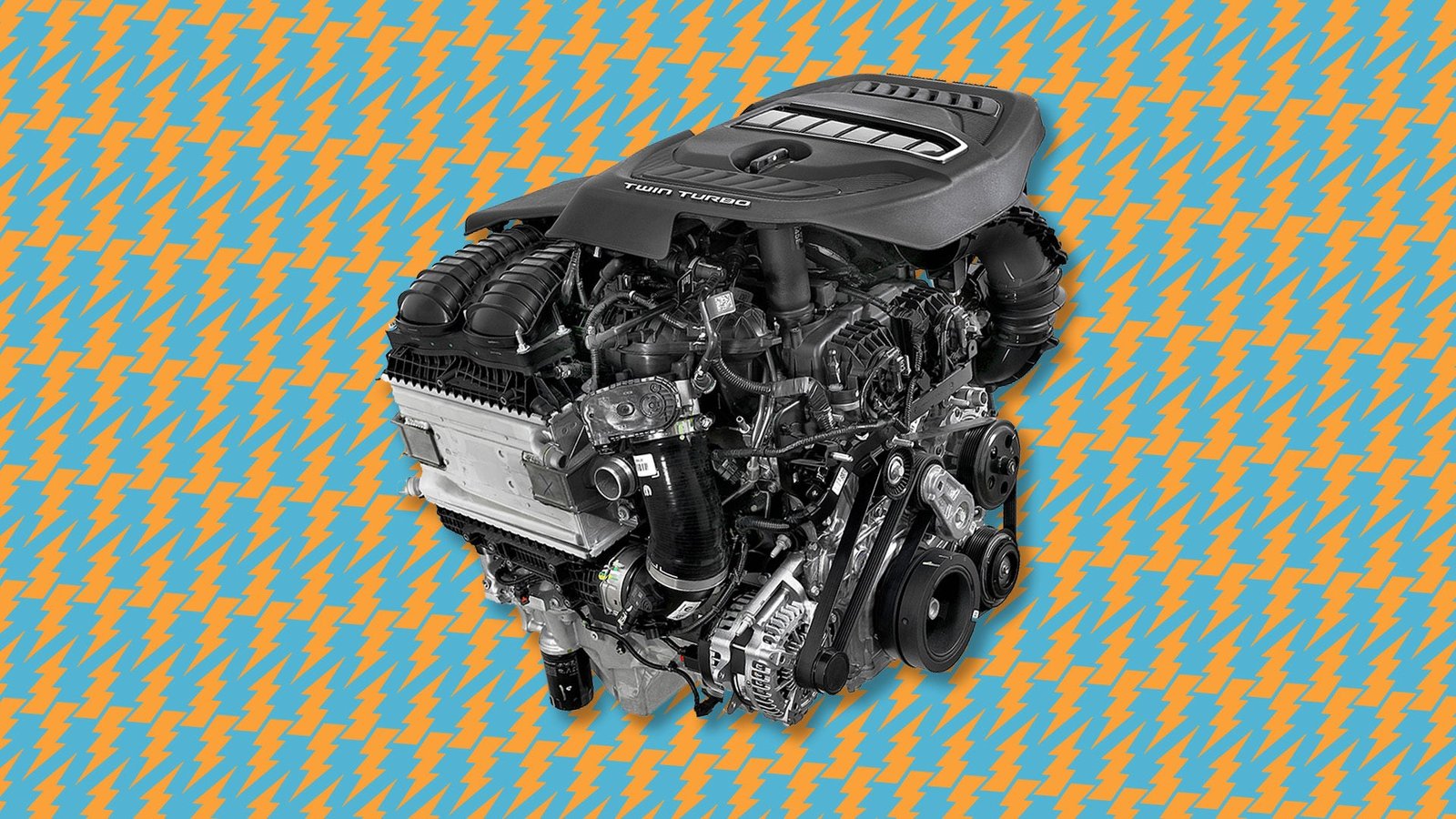

Forecasting Accelerating Sales Growth

The San Jose, Calif.-based chipmaker forecast accelerating sales growth in the current quarter when it delivered a beat-and-raise report for its fiscal first quarter. AVGO stock climbed 3% the day after the earnings news.

Broadcom earned an adjusted $8.39 a share, up 27% year over year, on sales of $7.71 billion, up 16%, in the quarter ended Jan. 30.

For its fiscal second quarter ending May 1, Broadcom predicted sales of $7.9 billion, up 20% year over year.

Broadcom makes wireless chips for smartphones. It also makes semiconductors for broadband communications, networking, storage and industrial applications. Plus, Broadcom has a growing business in infrastructure software for mainframes, data centers and cybersecurity.

Semiconductor products accounted for 76% of Broadcom’s revenue in the first quarter. Infrastructure software contributed 24% of sales.

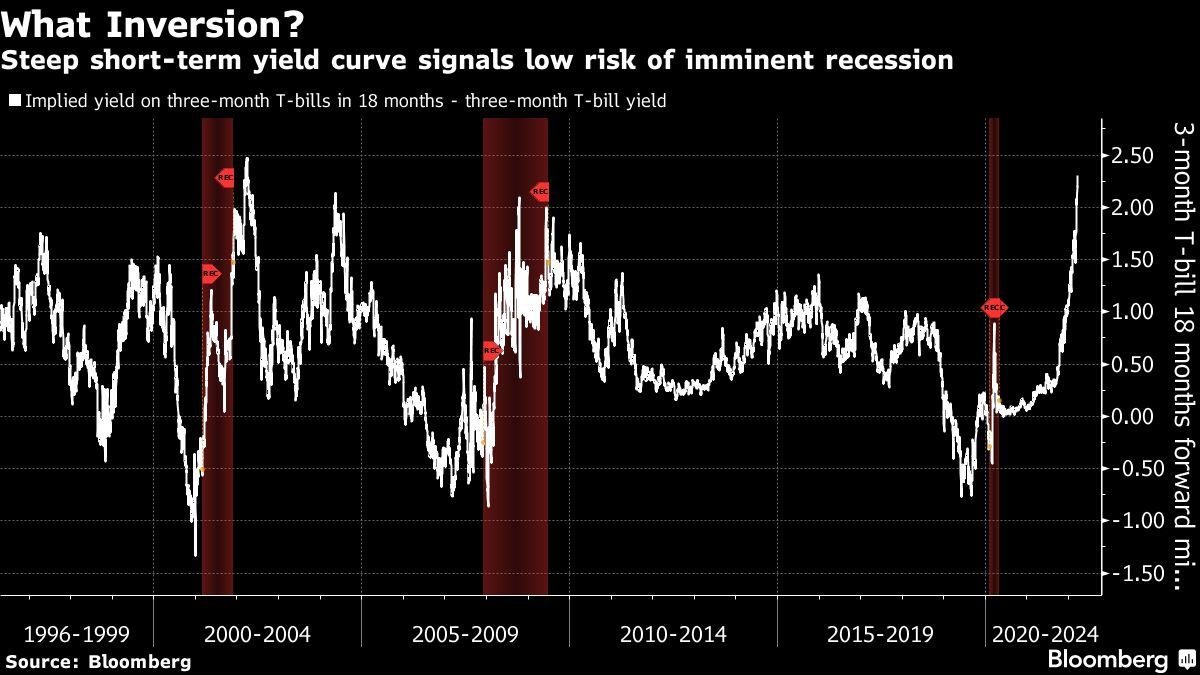

AVGO Stock Ranks Third In Industry Group

Piper Sandler analyst Harsh Kumar rates Broadcom stock as overweight, or buy, with a price target of 750.

“Broadcom is benefiting from upgrades in several of its end markets, including hyperscale, cloud, enterprise, wireless, and storage,” Kumar said in a recent note to clients. “At a broad level, demand and orders appear to be extending into the first half of calendar 2023.”

AVGO stock ranks third out of 30 stocks in IBD’s fabless semiconductor industry group, according to IBD Stock Checkup. It has an IBD Composite Rating of 96 out of 99. IBD’s Composite Rating is a blend of key fundamental and technical metrics to help investors gauge a stock’s strengths. The best growth stocks have a Composite Rating of 90 or better.

Follow Patrick Seitz on Twitter at @IBD_PSeitz for more stories on consumer technology, software and semiconductor stocks.

YOU MAY ALSO LIKE:

Qualcomm Well Positioned As Internet-Of-Things Chipmaker, Analyst Says

GlobalFoundries Stock Surges Amid Heightened Demand For Chips

Stocks To Buy And Watch: Top IPOs, Big And Small Caps, Growth Stocks

Find Winning Stocks With MarketSmith Pattern Recognition & Custom Screens

See Stocks On The List Of Leaders Near A Buy Point

![“Ghosts” recap: season 2, episode 10 – [Spoiler] To kiss](https://nokiamelodileri.com/wp-content/uploads/2022/12/Ghosts-recap-season-2-episode-10-Spoiler-To-kiss.jpg)

![The Walking Dead Recap: Season 11, Episode 23 — [Spoiler] Die?!?](https://nokiamelodileri.com/wp-content/uploads/2022/11/The-Walking-Dead-Recap-Season-11-Episode-23-—-Spoiler.jpg)

![‘She-Hulk’ Recap: Finale Criticizes MCU Tropes, Introduces [Spoiler]](https://nokiamelodileri.com/wp-content/uploads/2022/10/She-Hulk-Recap-Finale-Criticizes-MCU-Tropes-Introduces-Spoiler.jpeg)

![‘I mean, I kinda agree [with] them’](https://nokiamelodileri.com/wp-content/uploads/2022/03/I-mean-I-kinda-agree-with-them.jpeg)

![TikToker Admits He Lied About Jumping That Tesla to Go Viral [UPDATED]](https://nokiamelodileri.com/wp-content/uploads/2022/03/TikToker-Admits-He-Lied-About-Jumping-That-Tesla-to-Go.jpg)

![‘Good Trouble’: [Spoiler] Leaving in Season 4](https://nokiamelodileri.com/wp-content/uploads/2022/03/Good-Trouble-Spoiler-Leaving-in-Season-4.jpg)

![‘The Bachelor’ Recap: Season Finale—Clayton Picks [Spoiler]](https://nokiamelodileri.com/wp-content/uploads/2022/03/The-Bachelor-Recap-Season-Finale—Clayton-Picks-Spoiler.png)

![‘Upload’ Recap: Season 2 Premiere, Episode 1 — Ingrid Is [Spoiler]](https://nokiamelodileri.com/wp-content/uploads/2022/03/Upload-Recap-Season-2-Premiere-Episode-1-—-Ingrid-Is.jpg)

![[VIDEO] ‘The Masked Singer’ Premiere Recap: Season 7, Episode 1](https://nokiamelodileri.com/wp-content/uploads/2022/03/VIDEO-The-Masked-Singer-Premiere-Recap-Season-7-Episode-1.jpg)

![‘The Bachelor’ Recap: Fantasy Suites, Clayton and [Spoiler] break-up](https://nokiamelodileri.com/wp-content/uploads/2022/03/The-Bachelor-Recap-Fantasy-Suites-Clayton-and-Spoiler-break-up.png)

0