At the premiere of “Everything Everywhere All At Once” last spring, Alamo Drafthouse offered special screenings where attendees received packs of wide-eyed eyes. Peepers referred to a central character’s habit of putting the gag on everyone and everything he could. Then, when Jordan Peele’s twisted horror flick “Nope” opened in July, the Texas-based theater chain held a pop-up screening at a horse ranch in Hollywood. It was a sly nod to the siblings fighting over the horses at the center of the alien thriller. And when “The Menu,” a horror film that sends haute cuisine, debuted last November, Alamo offered multi-course feasts featuring slow-poached oysters and biodynamic wines for guests so that they can dine in style as the on-screen character was killed off with panache.

“We’re doing everything we can to bring people back to the movies,” says Sarah Pitre, head of movie programming at Alamo Drafthouse. “We are passionate about movies and want to do more to maximize the content we show. It’s about rebuilding that relationship with our customers.

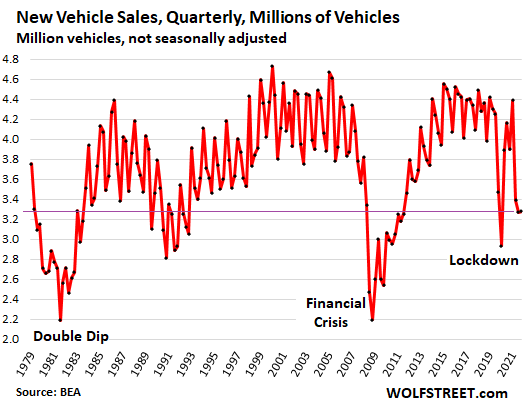

Going the extra mile seems to pay off. As a result, in a rollercoaster year for movies, Alamo outperformed the industry by double digits. It’s a reminder of the kind of turmoil that was needed at a time when the film industry was struggling, and largely failing, to regain its footing after the pandemic. Overall, domestic ticket sales have fallen more than 30% in 2022 from pre-COVID levels and analysts expect US revenue to hit just over 7 .5 billion dollars. This is largely due to the fact that studios released 40 fewer films in the past 12 months than in 2019 as they struggled to get projects back into production amid an unpredictable health crisis. The decline in theatrical releases roughly equaled the same shortfall in declining revenue. Theaters need movies to show and for much of 2022 there was too much empty space on their marquees.

“It was definitely a rebound year,” says Tearlach Hutcheson, vice president of filmmaking at Studio Movie Grill. “There’s still a lack of product from the studios, and it’s going to take time to change that.”

Theater owners believe next summer will be stronger, with the release of sequels such as ‘Guardians of the Galaxy’ and ‘The Fast and the Furious’. However, they don’t expect things to return to pre-pandemic levels until 2024. That’s a long wait for a company that’s been hit hard by a prolonged shutdown and changing tastes as the viewers are getting used to watching on streaming services. It’s already driving closures and bankruptcies – Cineworld, Regal’s owner and the world’s second-largest exhibitor, filed for Chapter 11 protection in September and some industry watchers believe other chains may be forced to follow if things don’t improve.

“You’re going to see a wave of bankruptcies,” predicted an executive, who spoke on condition of anonymity. “Private equity will likely come in, buy some of these theaters and shut down their underperforming screens and cut costs. They won’t leave, but it will be hard.

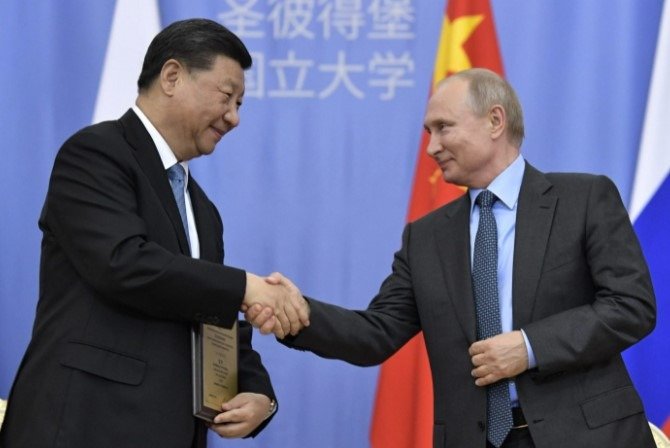

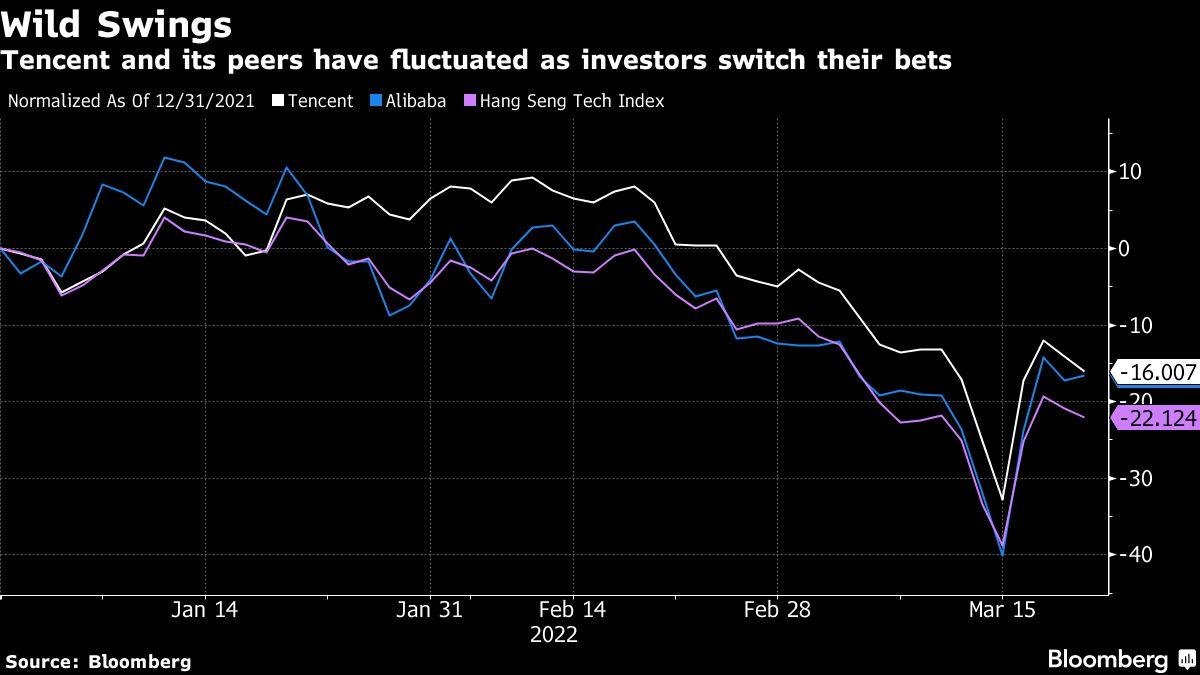

COVID and politics have fundamentally changed a company that, let’s face it, was shrinking even before the virus turned things upside down. It was an industry that had become dependent on spectacle and superheroes to sell tickets, and those cost a lot of money to deliver. As a result, the big changes that have taken place in a shrinking global landscape for theatrical releases are making it increasingly difficult for films to make a profit. Russia’s invasion of Ukraine means that Hollywood films are no longer shown in the country – it’s a big blow given that Russia is one of the 10 biggest film markets. Even more troubling, tensions between the United States and China have meant that fewer studio films are entering the country or facing unattractive release windows. And soaring COVID rates in the country may have had a negative impact on the results of “Avatar: The Way of the Water,” one of the few Hollywood productions to get a coveted release date in China. That’s a problem because for a major blockbuster with a budget of over $200 million, doing well in a market as massive as China can mean the difference between making a profit and losing money.

“China has been tumultuous, to say the least,” says Veronika Kwan Vandenberg, president of distribution for Universal Pictures International. “There are still plenty of opportunities in China, but that’s never a guarantee. It’s more of an icing on the cake. »

It was also a year of changing fortunes, exemplified most dramatically by Paramount Pictures, which had been largely written off as a major player after a decade of corporate change and instability. Instead, Paramount returned to the chase, featuring the highest-grossing release of the year in “Top Gun: Maverick” and complementing that with hits such as “Sonic the Hedgehog 2”, “The Lost City”, “Smile” and “Scream”. “Babylon,” Damien Chazelle’s $80 million look at the early days of the movie industry, was his only flop.

“It’s truly been a fantastic year,” said Brian Robbins, President and CEO of Paramount Pictures. “And I felt like we were living in an alternate universe.”

Indeed, the Paramount experiment seemed to take place in an alternate reality. Although it thrived, most other studios were plagued with painful failures. Disney missed the mark with its two animated feature films, “Strange World” and “Lightyear,” which both bombed at the box office and likely lost over $100 million each. Their collapse creates problems for family characteristics, which were one of the most reliable theatrical demographics before COVID turned things upside down. There have also been several attempts to launch or expand new franchises that have met with public indifference, such as Warner Bros. “Fantastic Beasts: Dumbledore’s Secrets” (it turns out no one cared where to find them); “Black Adam”, which saw new DC management announce that Dwayne Johnson’s anti-hero would not play a role in the next phase of his universe building; and Lionsgate’s “Moonfall,” a disaster movie that cost more than $140 million to produce and grossed an abysmal $67.3 million.

Prestige Fares, the kind of titles positioned to win awards, also struggled at the box office. Films like “She Said,” “Bones and All” and “The Fabelmans” won critical acclaim but failed to turn those reviews into rejoinders in multiplexes. These movies have yet to earn $15 million worldwide, a dismal result that could mean adult-oriented films, at least those without special effects and explosions, will continue to migrate to streaming services where they will be better isolated from advertisements. considerations.

So what worked? Franchises, especially those related to comics, continued to dominate the box office. Nationally, nine of the top 10 grossing films were sequels – the only entry that didn’t come with a Roman numeral, “The Batman,” wasn’t exactly an original film. It’s a reboot of a character who has graced over a dozen movies. And what worked for American crowds also worked for international ticket buyers. Globally, eight of the highest-grossing films were also sequels, with ‘The Batman’ and Chinese sci-fi comedy ‘Moon Man’ proving to be the exception to the rule. These films accounted for a disproportionate share of box office receipts. In 2022, the box office is more heavily concentrated at the top, with the top 10 grossing films contributing over 60% of total ticket sales, up from 47% in 2019. And that’s a problem, because these big films are supposed to be the big draws, but to keep the company humming, there needs to be more complementary pieces.

“Studios have always focused on home runs, but singles, doubles and triples have maintained distribution channels,” said exhibition industry consultant Greg Foster. “In 2022, there just weren’t enough wide releases.”

And while the summer box office got off to a strong start with ‘Top Gun: Maverick’ and built on that success with hits such as ‘Jurassic World: Dominion’ and ‘Minions: The Rise of Gru’, l company has entered a prolonged downturn. in August, from which he had not really recovered by the end of the year. Granted, there were some big hits such as “Black Panther: Wakanda Forever” and “Avatar: The Way of Water,” but those hits weren’t enough to lift other new releases. They’ve also been rare – for too long there weren’t any great movies to show. As a result, the likes of “Bros,” “Devotion” and “Easter Sunday” suffered some of the worst super-release debuts in movie history.

“We’ve had some problematic lulls in 2022,” said Megan Colligan, President of Imax Entertainment. “Having a lull in August happens all the time. You can live it. But when November and December are lulls, it’s not good.

As for theater executives like Pitre, they’re already anticipating the coming months, hoping to find the kind of offbeat or unconventional offerings that can draw in crowds and act as a bridge to the next blockbuster. She thinks she may have found one in “Cocaine Bear,” a darkly comedic thriller about a black bear who ingests a lot of punches and goes on a murderous rampage.

“We have some pretty crazy ideas for parties that we can throw in our theater lobbies,” says Pitre. “It’s the kind of movie we like.”

![“Ghosts” recap: season 2, episode 10 – [Spoiler] To kiss](https://nokiamelodileri.com/wp-content/uploads/2022/12/Ghosts-recap-season-2-episode-10-Spoiler-To-kiss.jpg)

![The Walking Dead Recap: Season 11, Episode 23 — [Spoiler] Die?!?](https://nokiamelodileri.com/wp-content/uploads/2022/11/The-Walking-Dead-Recap-Season-11-Episode-23-—-Spoiler.jpg)

![‘She-Hulk’ Recap: Finale Criticizes MCU Tropes, Introduces [Spoiler]](https://nokiamelodileri.com/wp-content/uploads/2022/10/She-Hulk-Recap-Finale-Criticizes-MCU-Tropes-Introduces-Spoiler.jpeg)

![‘I mean, I kinda agree [with] them’](https://nokiamelodileri.com/wp-content/uploads/2022/03/I-mean-I-kinda-agree-with-them.jpeg)

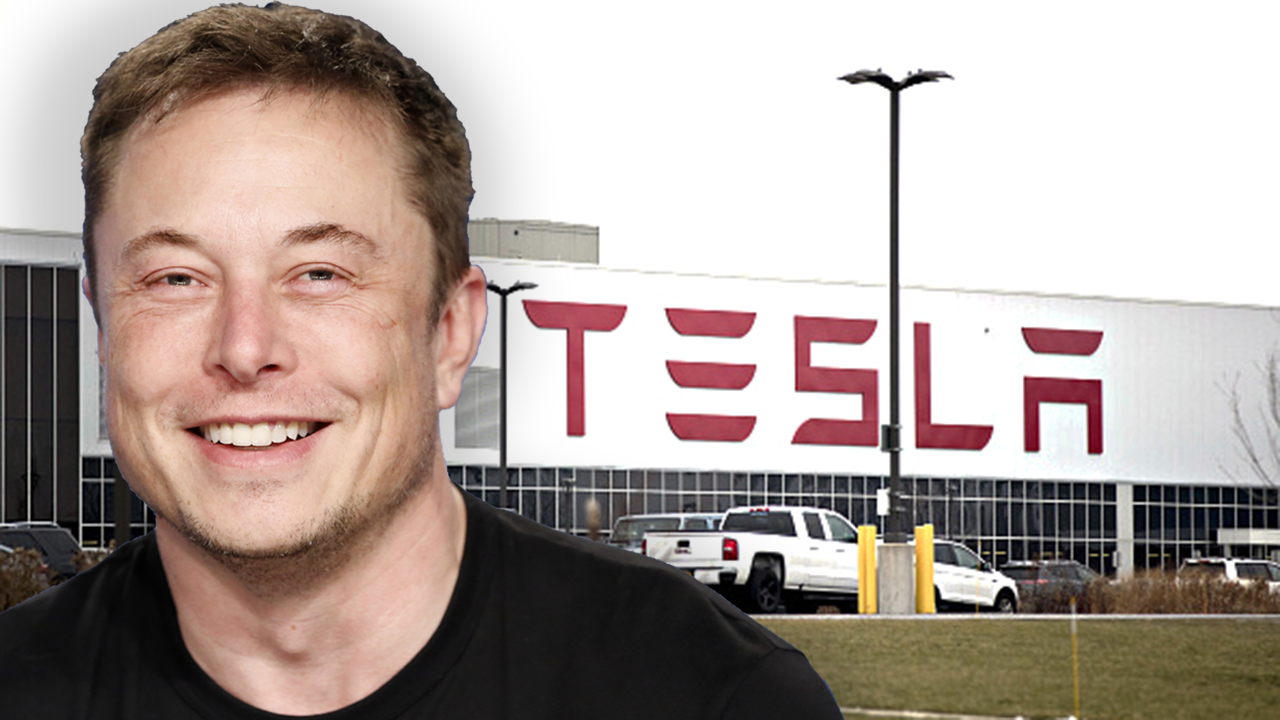

![TikToker Admits He Lied About Jumping That Tesla to Go Viral [UPDATED]](https://nokiamelodileri.com/wp-content/uploads/2022/03/TikToker-Admits-He-Lied-About-Jumping-That-Tesla-to-Go.jpg)

![‘Good Trouble’: [Spoiler] Leaving in Season 4](https://nokiamelodileri.com/wp-content/uploads/2022/03/Good-Trouble-Spoiler-Leaving-in-Season-4.jpg)

![‘The Bachelor’ Recap: Season Finale—Clayton Picks [Spoiler]](https://nokiamelodileri.com/wp-content/uploads/2022/03/The-Bachelor-Recap-Season-Finale—Clayton-Picks-Spoiler.png)

![‘Upload’ Recap: Season 2 Premiere, Episode 1 — Ingrid Is [Spoiler]](https://nokiamelodileri.com/wp-content/uploads/2022/03/Upload-Recap-Season-2-Premiere-Episode-1-—-Ingrid-Is.jpg)

![[VIDEO] ‘The Masked Singer’ Premiere Recap: Season 7, Episode 1](https://nokiamelodileri.com/wp-content/uploads/2022/03/VIDEO-The-Masked-Singer-Premiere-Recap-Season-7-Episode-1.jpg)

![‘The Bachelor’ Recap: Fantasy Suites, Clayton and [Spoiler] break-up](https://nokiamelodileri.com/wp-content/uploads/2022/03/The-Bachelor-Recap-Fantasy-Suites-Clayton-and-Spoiler-break-up.png)

0