The cost of building a battery-powered truck will “forever be higher” than a combustion engine equivalent, the boss of the world’s largest truckmaker has warned, as the war in Ukraine accelerates an already rapid rise in the price of crucial commodities.

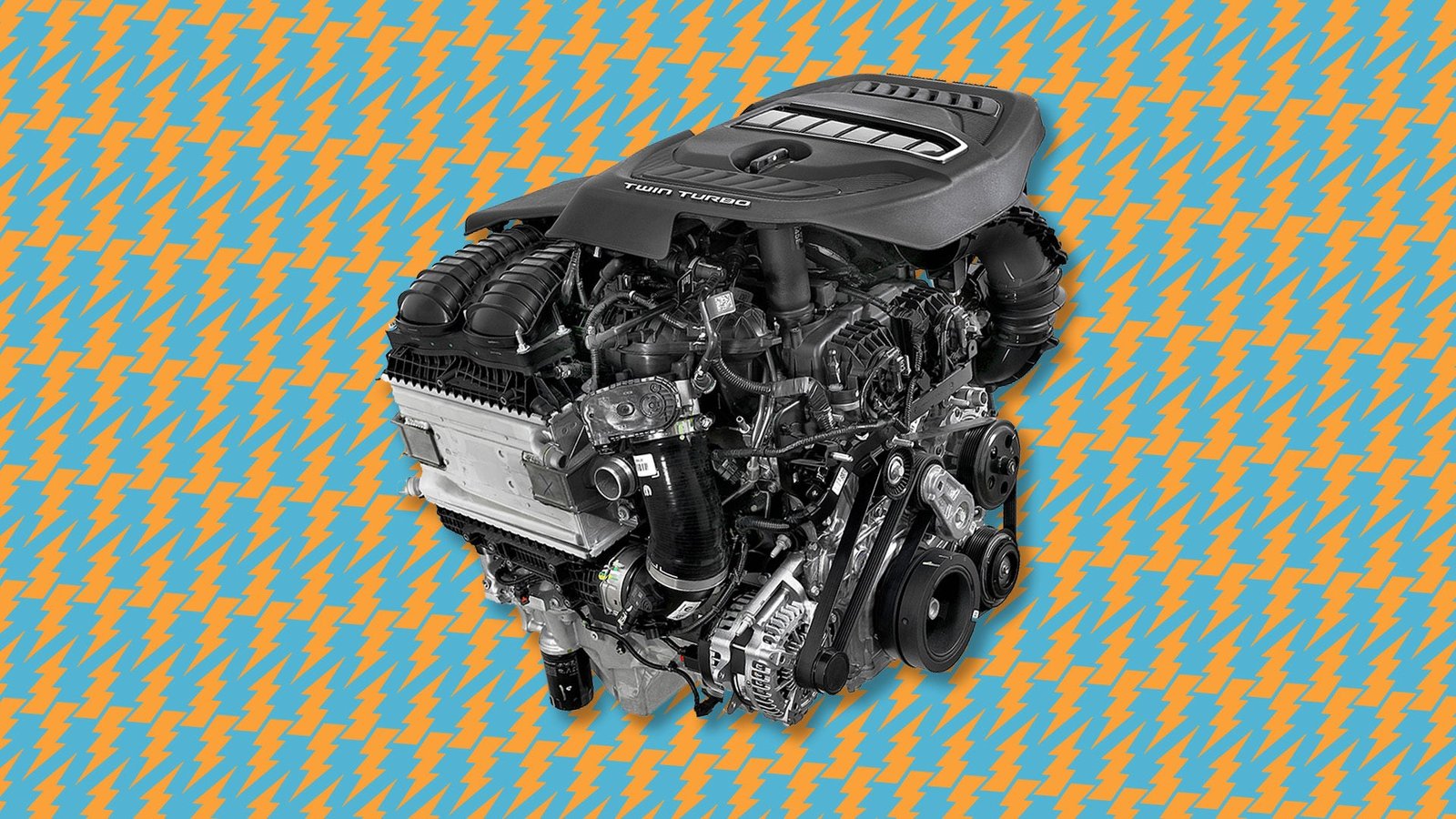

“If you take the entirety of engine, transmission, axle, tank system, cooling . . . ” the chief executive officer of Daimler Truck, Martin Daum, told the Financial Times, “we have a maximum of about €25,000 [of material in a combustion engine truck].”

“How much battery do you get for €25,000? Even if [battery costs fall to] €60 per kilowatt hour, and I need 400 kilowatt hours, then I need €24,000 alone for the battery cells [in a single truck]”.

He added that it would be up to governments to make up the difference, using whichever mechanism they thing. “Without any subsidies. . . the price of an [electric] truck will always, forever be higher than a [combustion engine] truck.”

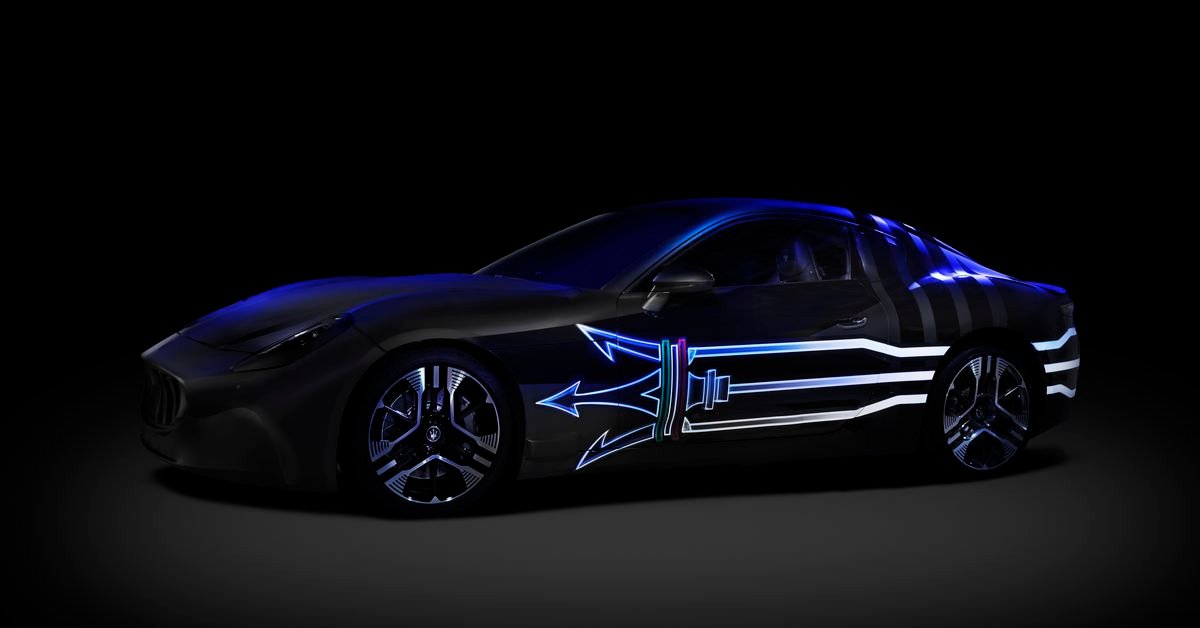

Daum’s comments come after Daimler Truck, which was an early entrant into the electric market and has been manufacturing batter-powered vehicles since 2017, reported that it had more than tripled the sales of zero-emission trucks and buses last year, to a total of 712.

However, that accounts for a fraction of the 455,000 trucks and buses the company delivered in total in 2021.

Its long-haul eActros model, which went into series production last year, still costs three times the price of its combustion engine equivalent, and that gap is unlikely to narrow significantly in the near future.

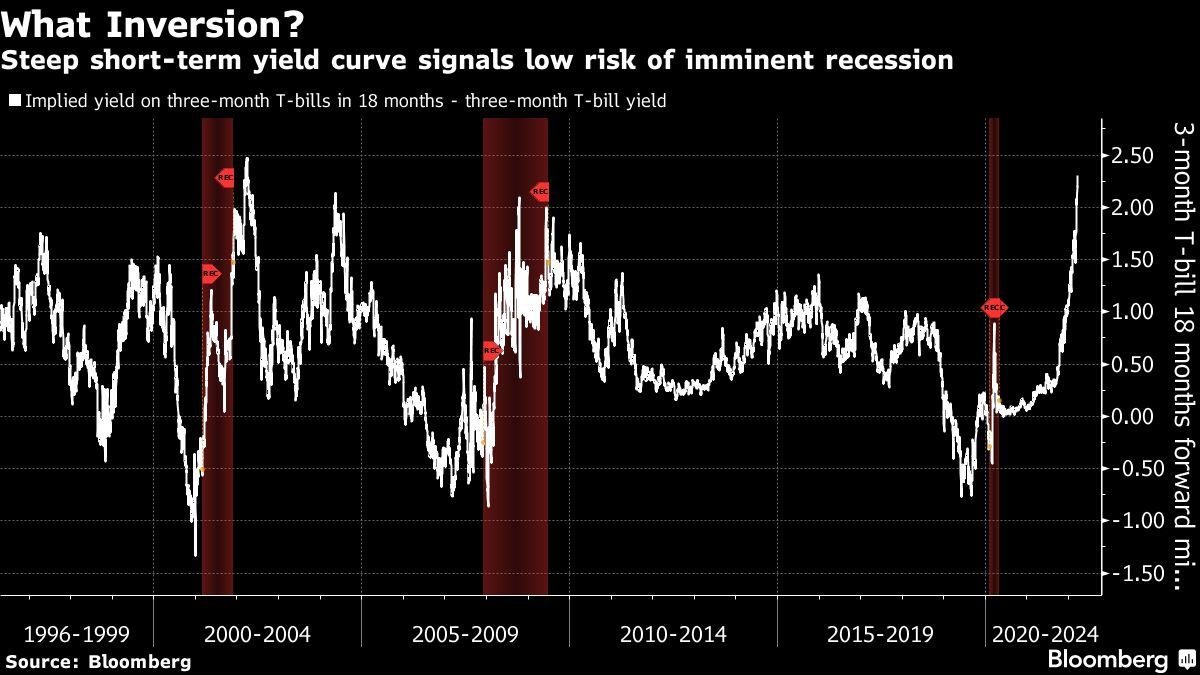

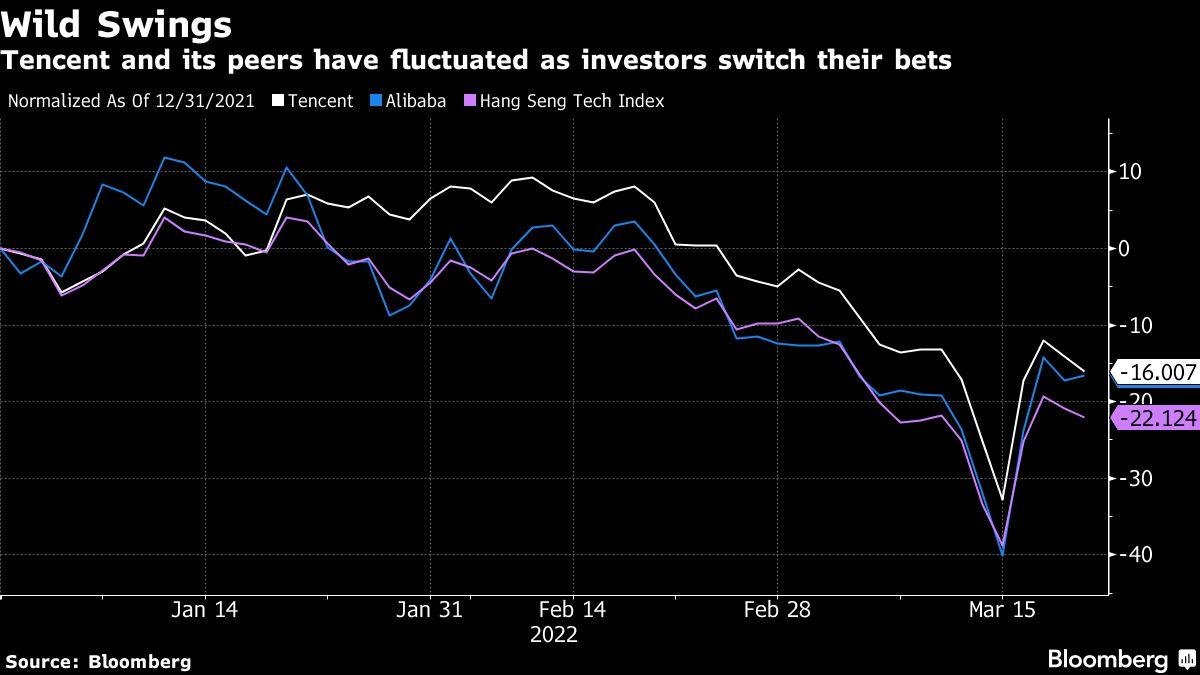

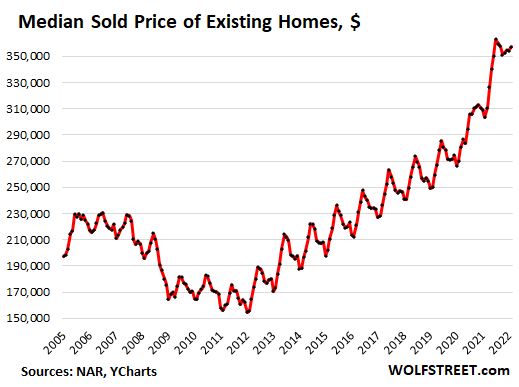

The cost of the key raw materials used in modern batteries has risen sharply over the past year, with cobalt and lithium more than doubling in price, and nickel climbing by almost 40 per cent, according to IHS Markit.

As a result, battery pack prices, which fell to an average of $132 per kilowatt hour in 2021, according to a survey conducted by BloombergNEF, are predicted to remain above the $100 level until at least 2024.

Daum, who like other bosses in the industry has called for a tax on carbon to narrow the cost disparity between combustion engine trucks and battery-powered models, said he nevertheless supported efforts by the German government to help businesses deal with soaring diesel costs.

“We have to raise the price over time,” the executive said, “we can live with two or three euros per litre, but we can’t live if that comes overnight.”

Daimler Truck, whose longstanding strategy has been to pursue both battery-powered and hydrogen trucks, could focus more on the latter if battery costs continued to soar, and commodities remained scarce, Daum added.

“In the fuel cell, we have far less rare raw material,” he said, “and we don’t compete with millions of passenger cars for the same material.”

Daum praised German economics minister Robert Habeck for signing an agreement with Qatar last week for the delivery of hydrogen, as well as for the supply of liquid natural gas.

But he criticized antitrust authorities in Brussels for dragging their feet when it comes to approving a joint venture between Daimler and its key competitors Volvo and Traton, which will spend €500mn on developing a network of 1700 truck charging points in Europe.

“We are ready to invest the money,” he said, “we have someone ready to take over the chief executive role and she can’t do it because we don’t have the approval.

“It should have been done three months ago. We should have been up and running operationally.”

![“Ghosts” recap: season 2, episode 10 – [Spoiler] To kiss](https://nokiamelodileri.com/wp-content/uploads/2022/12/Ghosts-recap-season-2-episode-10-Spoiler-To-kiss.jpg)

![The Walking Dead Recap: Season 11, Episode 23 — [Spoiler] Die?!?](https://nokiamelodileri.com/wp-content/uploads/2022/11/The-Walking-Dead-Recap-Season-11-Episode-23-—-Spoiler.jpg)

![‘She-Hulk’ Recap: Finale Criticizes MCU Tropes, Introduces [Spoiler]](https://nokiamelodileri.com/wp-content/uploads/2022/10/She-Hulk-Recap-Finale-Criticizes-MCU-Tropes-Introduces-Spoiler.jpeg)

![‘I mean, I kinda agree [with] them’](https://nokiamelodileri.com/wp-content/uploads/2022/03/I-mean-I-kinda-agree-with-them.jpeg)

![TikToker Admits He Lied About Jumping That Tesla to Go Viral [UPDATED]](https://nokiamelodileri.com/wp-content/uploads/2022/03/TikToker-Admits-He-Lied-About-Jumping-That-Tesla-to-Go.jpg)

![‘Good Trouble’: [Spoiler] Leaving in Season 4](https://nokiamelodileri.com/wp-content/uploads/2022/03/Good-Trouble-Spoiler-Leaving-in-Season-4.jpg)

![‘The Bachelor’ Recap: Season Finale—Clayton Picks [Spoiler]](https://nokiamelodileri.com/wp-content/uploads/2022/03/The-Bachelor-Recap-Season-Finale—Clayton-Picks-Spoiler.png)

![‘Upload’ Recap: Season 2 Premiere, Episode 1 — Ingrid Is [Spoiler]](https://nokiamelodileri.com/wp-content/uploads/2022/03/Upload-Recap-Season-2-Premiere-Episode-1-—-Ingrid-Is.jpg)

![[VIDEO] ‘The Masked Singer’ Premiere Recap: Season 7, Episode 1](https://nokiamelodileri.com/wp-content/uploads/2022/03/VIDEO-The-Masked-Singer-Premiere-Recap-Season-7-Episode-1.jpg)

![‘The Bachelor’ Recap: Fantasy Suites, Clayton and [Spoiler] break-up](https://nokiamelodileri.com/wp-content/uploads/2022/03/The-Bachelor-Recap-Fantasy-Suites-Clayton-and-Spoiler-break-up.png)

0