- In March, mortgage rates rose to 4.79%, according to mortgage data firm Black Knight.

- The number of people locking in mortgages for new homes increased by 31%, the firm found.

- It’s the latest sign that homebuyers are trying to lock in lower rates before they rise further.

The number of buyers who locked in loans to purchase new homes increased 31% in March, a new report from mortgage analytics firm Black Knight said, signaling that people are rushing to secure low rates while they can.

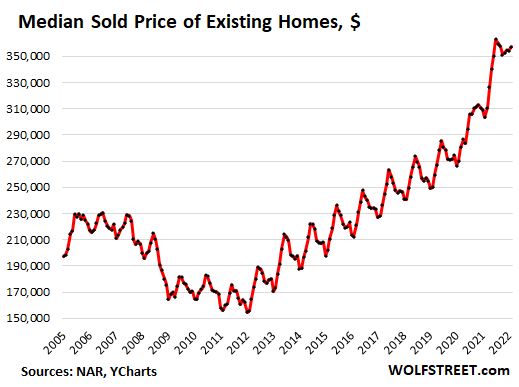

From the start of 2020 until recently, homebuyers were treated to historically low mortgage rates, the byproduct of efforts from the

Federal Reserve

to boost the economy during pandemic slowdowns. During 2020, for the first time ever, 30-year fixed mortgage rates fell below 3%. They remained low through 2021.

But those lows are already a thing of the past.

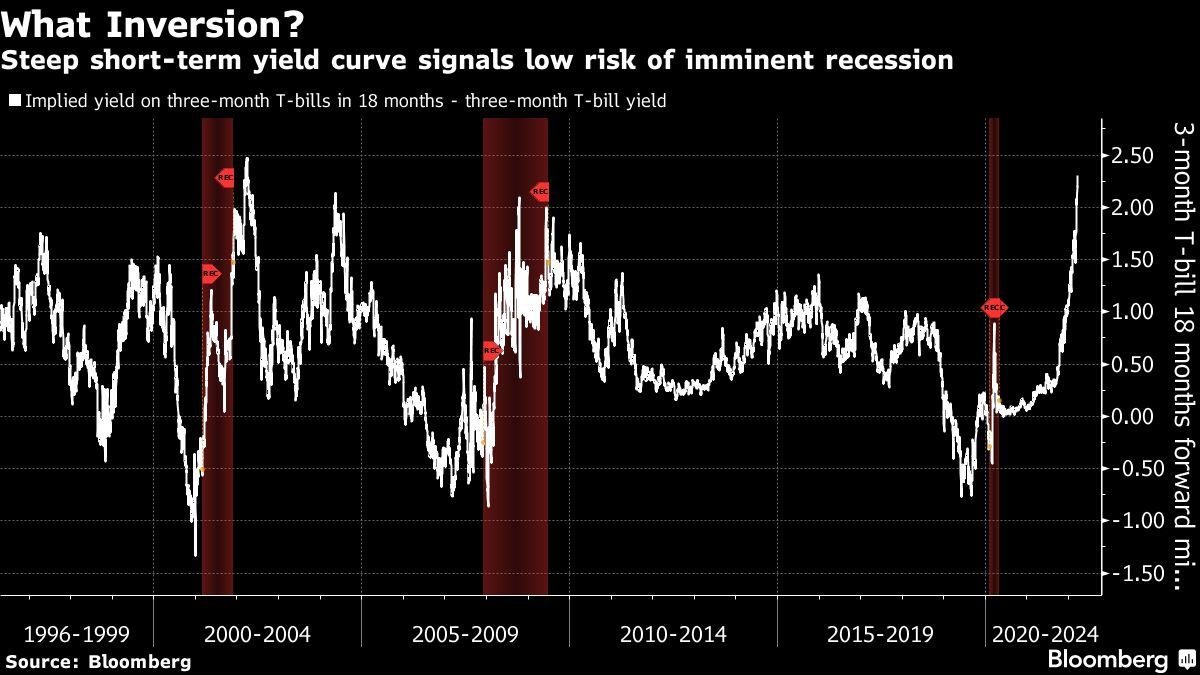

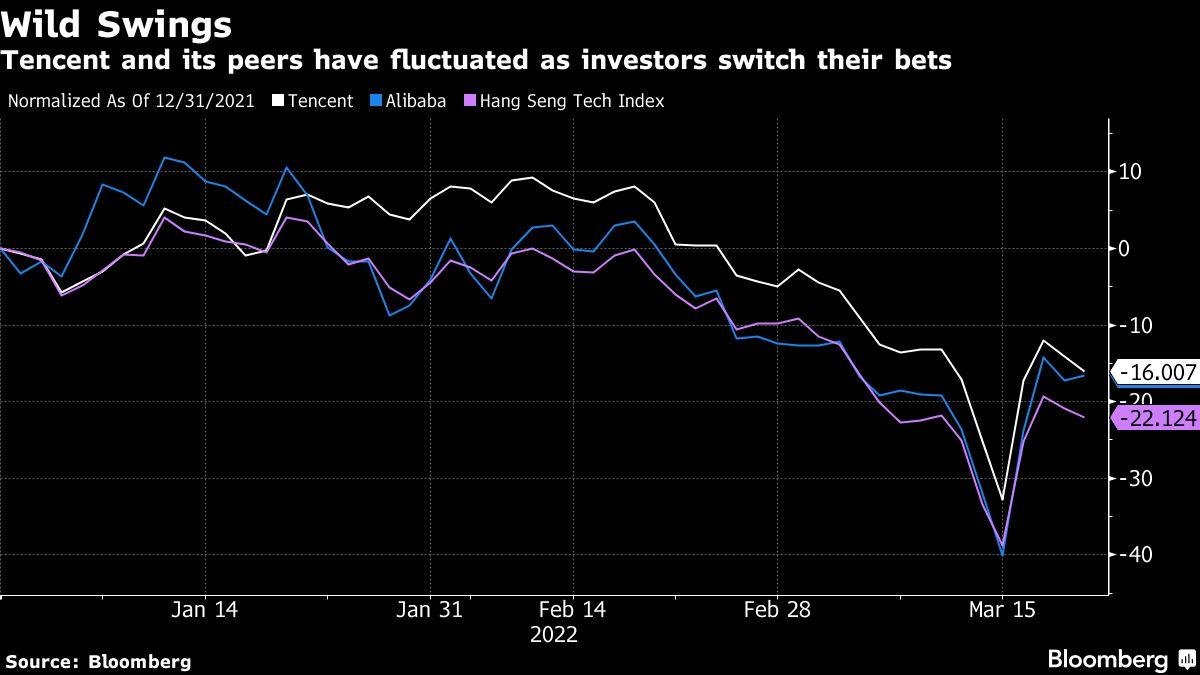

The Fed signaled in January that it would raise interest rates to curb inflation. On March 16, it did. Lenders boosted interest rates on mortgages soon after.

The 30-year mortgage rate finished March at 4.79%, according to Black Knight, up from 4.09% in February. This was the largest month-over-month rate increase in almost 13 years, the company said.

Buyers are responding by racing to lock in rates that allow them to more easily afford new homes.

“We saw purchase lock volumes increase by 31% from February — likely as prospective buyers moved to lock in their loans before rates climbed any higher,” Scott Happ, Black Knight’s president of secondary marketing technologies, said in the April 11 report.

Mortgage “locks” guarantee the current rate on a home loan for a certain amount of time, usually from 30 to 60 days.

Even though mortgage rates are not yet significantly higher than pre-pandemic levels, the sharp increase still worries buyers.

For one, higher rates put a dent in the amount of house people can afford. For example, a few months ago, you may have been able to lock in a 3.5% rate on a 30-year mortgage for $300,000. Your monthly payment on the principal and interest would have been $1,347.13.

Let’s say you apply for a mortgage for the same amount now, but you lock in a 4% rate instead. With the higher rate, that monthly payment is $1,432.25. Your monthly payment goes up by less than $100 because you waited a month to lock in a rate.

Those with a fear of missing out on the low rates they’ve seen in the past year are also facing other challenges, like record-high home prices. In March, the national median listing price for active listings increased 13.5% from the year before, to $405,000, according to a report from Realtor.com.

Buyers’ haste to secure low rates — and to find a home they both love and can afford — can lead to regrets.

Earlier this year, Kori McClinton, a 26-year-old disability analyst in New Orleans, locked in a 2.9% rate after her grandmother urged her to hurry. Though she was happy with her rate, McClinton ended up paying $25,000 over asking for a house in a neighborhood with a higher flood risk that she wasn’t completely in love with.

“I do feel like I settled a bit,” McClinton told Insider.

![“Ghosts” recap: season 2, episode 10 – [Spoiler] To kiss](https://nokiamelodileri.com/wp-content/uploads/2022/12/Ghosts-recap-season-2-episode-10-Spoiler-To-kiss.jpg)

![The Walking Dead Recap: Season 11, Episode 23 — [Spoiler] Die?!?](https://nokiamelodileri.com/wp-content/uploads/2022/11/The-Walking-Dead-Recap-Season-11-Episode-23-—-Spoiler.jpg)

![‘She-Hulk’ Recap: Finale Criticizes MCU Tropes, Introduces [Spoiler]](https://nokiamelodileri.com/wp-content/uploads/2022/10/She-Hulk-Recap-Finale-Criticizes-MCU-Tropes-Introduces-Spoiler.jpeg)

![‘I mean, I kinda agree [with] them’](https://nokiamelodileri.com/wp-content/uploads/2022/03/I-mean-I-kinda-agree-with-them.jpeg)

![TikToker Admits He Lied About Jumping That Tesla to Go Viral [UPDATED]](https://nokiamelodileri.com/wp-content/uploads/2022/03/TikToker-Admits-He-Lied-About-Jumping-That-Tesla-to-Go.jpg)

![‘Good Trouble’: [Spoiler] Leaving in Season 4](https://nokiamelodileri.com/wp-content/uploads/2022/03/Good-Trouble-Spoiler-Leaving-in-Season-4.jpg)

![‘The Bachelor’ Recap: Season Finale—Clayton Picks [Spoiler]](https://nokiamelodileri.com/wp-content/uploads/2022/03/The-Bachelor-Recap-Season-Finale—Clayton-Picks-Spoiler.png)

![‘Upload’ Recap: Season 2 Premiere, Episode 1 — Ingrid Is [Spoiler]](https://nokiamelodileri.com/wp-content/uploads/2022/03/Upload-Recap-Season-2-Premiere-Episode-1-—-Ingrid-Is.jpg)

![[VIDEO] ‘The Masked Singer’ Premiere Recap: Season 7, Episode 1](https://nokiamelodileri.com/wp-content/uploads/2022/03/VIDEO-The-Masked-Singer-Premiere-Recap-Season-7-Episode-1.jpg)

![‘The Bachelor’ Recap: Fantasy Suites, Clayton and [Spoiler] break-up](https://nokiamelodileri.com/wp-content/uploads/2022/03/The-Bachelor-Recap-Fantasy-Suites-Clayton-and-Spoiler-break-up.png)

0