US stock futures were firmly in the green Friday morning as investors looked ahead to a new month of trading and mulled fresh data out of Washington on the state of the labor market.

Contracts on the S&P 500 and Dow Jones Industrial average each climbed 0.4% in early-hour trading. Futures on the Nasdaq Composite advanced 0.5%. The moves come after Wall Street’s most closely-watched indexes all logged their worst quarter since the start of 2020.

Investors on Friday are set to closely monitor the Labor Department’s monthly jobs report, offering the most up-to-date snapshot of the strength in hiring across the US economy. US employers added 431,000 jobs in March. Consensus economists are looking for non-farm payrolls to rise by 490,000 for March, according to Bloomberg data, slowing from February’s 678,000 gain but still marking an increase well above pre-pandemic trends. The unemployment rate fell to 3.6%, better than the expected 3.7% — the lowest since February 2020.

Stocks are pushing ahead into April following a volatile month and quarter of trading. The S&P 500 and Dow each dropped more than 4.5% for the first three months of 2022, closing out their worst quarters — and first quarterly declines — since the first quarter of 2020. The Nasdaq Composite saw the biggest decline, shedding 9.1% over the past three-month period, as investors rotated away from the technology and growth stocks that had led the market higher last year.

April has historically been a strong month for stocks, and has in fact produced a positive return for the S&P 500 in 15 of the last 16 years, according to LPL Financial’s Ryan Detrick. This time, however, stocks are facing a variety of headwinds that may upend this historically positive seasonality.

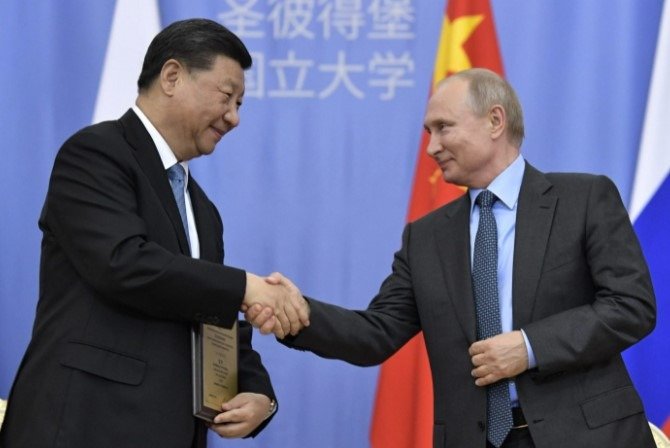

Namely, a confluence of concerns around the geopolitical and macroeconomic backdrop contributed to stocks’ worst quarterly performance in two years, and have yet to be fully resolved. Geopolitical risks have been elevated since Russia’s invasion of Ukraine in late February, raising the specter of further snarls to global supply chains that have already been struggling to recover from pandemic-era disruptions. A broad-based spike in prices, and in oil and energy prices especially, has further stoked concerns over the resilience of the consumer — the key driver of the domestic economy — going forward. And the Federal Reserve has begun a protracted process of raising interest rates and tightening financial conditions in a market that had grown accustomed to easy monetary policy since 2020.

“I think investors are very happy that the quarter is over. It was a tough one. Obviously inflation was bad all the way until … the end of the quarter,” Robert Cantwell, Upholdings portfolio manager, told Yahoo Finance Live on Thursday . “And in all likelihood, the next four to six weeks, it’s likely going to continue to be bad news because inflation is persistent, and we’re still comping record growth rates from the first four months of last year.”

“That said, as you get to the second half of next quarter, you could see a scenario where growth rates start accelerating again while inflation tempers, and that has the potential to bring a lot of the bulls back into the market,” he added .

LPL Financial points out that corporate profits may be another component driving the latest rebound in equities. Even in the face of war in Eastern Europe and decades-high inflation, earnings have been holding up, and estimates for S&P 500 Index earnings per share over the next four quarters are higher in March. Although not by much at 1.5%, the positive forecast is significant under the circumstances – particularly compared to how other countries have fared. Inflation is driving the more sizable corporate profits as companies enjoy more pricing power as they pass along higher costs to customers.

“On the back of energy independence, the trajectory of US corporate profits has been unaffected by energy costs and high inflation so far,” LPL Financial equity strategist Jeffrey Buchbinder noted, adding that conversely, earnings expectations in international rising markets have fallen in March. “The US profit outlook is the envy of the world right now.”

Elsewhere on the companies front, meme-stock favorite GameStop revealed in a form 8-K filed with the SEC after the bell Thursday that the video-game retailer will seek approval for a stock split at its upcoming shareholder meeting. GME is following a growing list of major companies — Alphabet, Amazon, Tesla — it what could be the “summer of stock splits.” Stock splits are a corporate action taken to improve trading liquidity and make shares more affordable without impacting market capitalization. GME rallied as much as 20% in extended trading to a 4-month high of more than $200 per share following the news.

8:30 am ET: New payrolls come in lower than expected

The US economy notched another sizable payroll gain in March as the labor market extending its strong and speedy recovery to bring employment back to pre-pandemic levels. US employers added 431,000 jobs, lower than the expected 490,000 jobs. Meanwhile the unemployment rate fell to 3.6% from 3.8% in February.

—

7:14 am ET Thursday: Futures charge higher to kick off April trading

Here were the main moves in futures trading ahead of the open Friday:

-

S&P 500 futures (ES=F): +22.00 points (+0.49%) to 4,552.75

-

Dow futures (YM=F): +172.00 points (+0.50%) to 34,790.00

-

Nasdaq futures (NQ=F): +80.00points (+0.45%) to 14,948.75

-

Raw (CL=F): +$0.14 (+0.14%) to $100.14 a barrel

-

Gold (GC=F): -$21.90 (-1.12%) to $1,932.10 per ounce

-

10-year Treasury (^TNX): 0.00 bps to yield 2.3270%

—

6:12 pm ET Thursday: Stock futures open slightly higher

Here’s where the major stock index futures opened Thursday evening:

-

S&P 500 futures (ES=F): +12.5 points (+0.28%) to 4,543.25

-

Dow futures (YM=F): +100 points (+0.29%) to 34,718.00

-

Nasdaq futures (NQ=F): +51.75 points (+0.35%) to 14,920.50

—

Emily McCormick is a reporter for Yahoo Finance. Follow her on Twitter.

Read the latest financial and business news from Yahoo Finance

Follow Yahoo Finance on Twitter, instagram, Youtube, Facebook, Flipboardand LinkedIn

![“Ghosts” recap: season 2, episode 10 – [Spoiler] To kiss](https://nokiamelodileri.com/wp-content/uploads/2022/12/Ghosts-recap-season-2-episode-10-Spoiler-To-kiss.jpg)

![The Walking Dead Recap: Season 11, Episode 23 — [Spoiler] Die?!?](https://nokiamelodileri.com/wp-content/uploads/2022/11/The-Walking-Dead-Recap-Season-11-Episode-23-—-Spoiler.jpg)

![‘She-Hulk’ Recap: Finale Criticizes MCU Tropes, Introduces [Spoiler]](https://nokiamelodileri.com/wp-content/uploads/2022/10/She-Hulk-Recap-Finale-Criticizes-MCU-Tropes-Introduces-Spoiler.jpeg)

![‘I mean, I kinda agree [with] them’](https://nokiamelodileri.com/wp-content/uploads/2022/03/I-mean-I-kinda-agree-with-them.jpeg)

![TikToker Admits He Lied About Jumping That Tesla to Go Viral [UPDATED]](https://nokiamelodileri.com/wp-content/uploads/2022/03/TikToker-Admits-He-Lied-About-Jumping-That-Tesla-to-Go.jpg)

![‘Good Trouble’: [Spoiler] Leaving in Season 4](https://nokiamelodileri.com/wp-content/uploads/2022/03/Good-Trouble-Spoiler-Leaving-in-Season-4.jpg)

![‘The Bachelor’ Recap: Season Finale—Clayton Picks [Spoiler]](https://nokiamelodileri.com/wp-content/uploads/2022/03/The-Bachelor-Recap-Season-Finale—Clayton-Picks-Spoiler.png)

![‘Upload’ Recap: Season 2 Premiere, Episode 1 — Ingrid Is [Spoiler]](https://nokiamelodileri.com/wp-content/uploads/2022/03/Upload-Recap-Season-2-Premiere-Episode-1-—-Ingrid-Is.jpg)

![[VIDEO] ‘The Masked Singer’ Premiere Recap: Season 7, Episode 1](https://nokiamelodileri.com/wp-content/uploads/2022/03/VIDEO-The-Masked-Singer-Premiere-Recap-Season-7-Episode-1.jpg)

![‘The Bachelor’ Recap: Fantasy Suites, Clayton and [Spoiler] break-up](https://nokiamelodileri.com/wp-content/uploads/2022/03/The-Bachelor-Recap-Fantasy-Suites-Clayton-and-Spoiler-break-up.png)

0