Kuzma/iStock via Getty Images

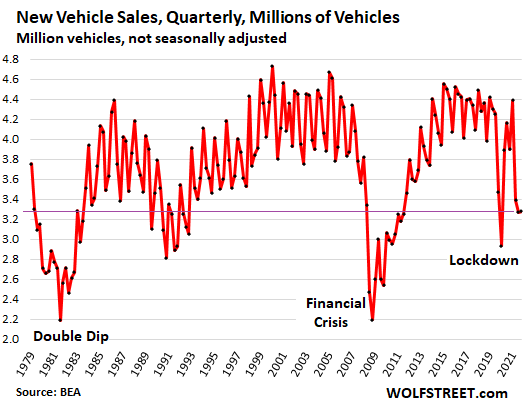

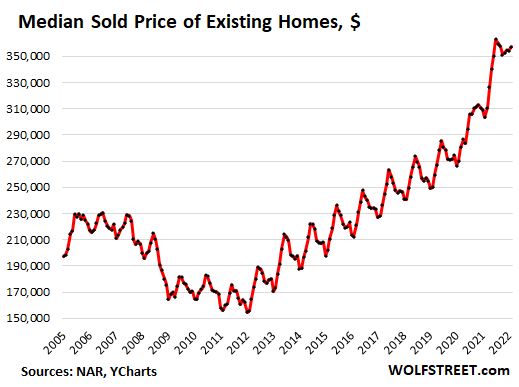

In a backdrop of consumer price inflation surging at multi-decade highs, the historic acceleration in US home prices since the onset of the COVID-19 pandemic is “out of step” with market fundamentals, according to a blog post by the Federal Reserve Bank of Dallas.

“Our evidence points to abnormal US housing market behavior for the first time since the boom of the early 2000s,” the Dallas Fed highlighted, citing real time housing market data characterizing potential signs of “exuberance.” The data suggests that “the US housing market has been showing signs of exuberance for more than five consecutive quarters through third quarter 2021.”

Price-to-rent ratios in particular have become unhinged from market fundamentals and moved into the exuberance stage, or “expectations-driven explosive appreciation,” the Dallas Fed researchers noted. For company-specific context, Pennsylvania REIT’s (PEI) robust fourth-quarter funds from operations reflected higher rents and occupancy rates. This comes as rental affordability issues rose in February as US residents spent an average of 30% of their monthly budgets on rents.

The researchers also pointed to the ratio of home prices to disposable income, a measure that’s linked directly with housing affordability. “The rapid increase in the statistic close to the threshold during 2021 indicates that US real house prices may soon become untethered from personal disposable income per capita.” In an environment where consumers’ purchasing power is declining, real disposable income contracted by 1.6% Y/Y in February and has remained in negative territory since April 2021, about the same time when real economic growth peaked, according to data from FRED.

Unlike the 2007-2009 Great Financial Crisis, household balance sheets seem to be in better shape along with stronger equity positions, suggesting that any economic headwinds from a correction in home prices will not be on the same scale experienced during the GFC, according to the blog.

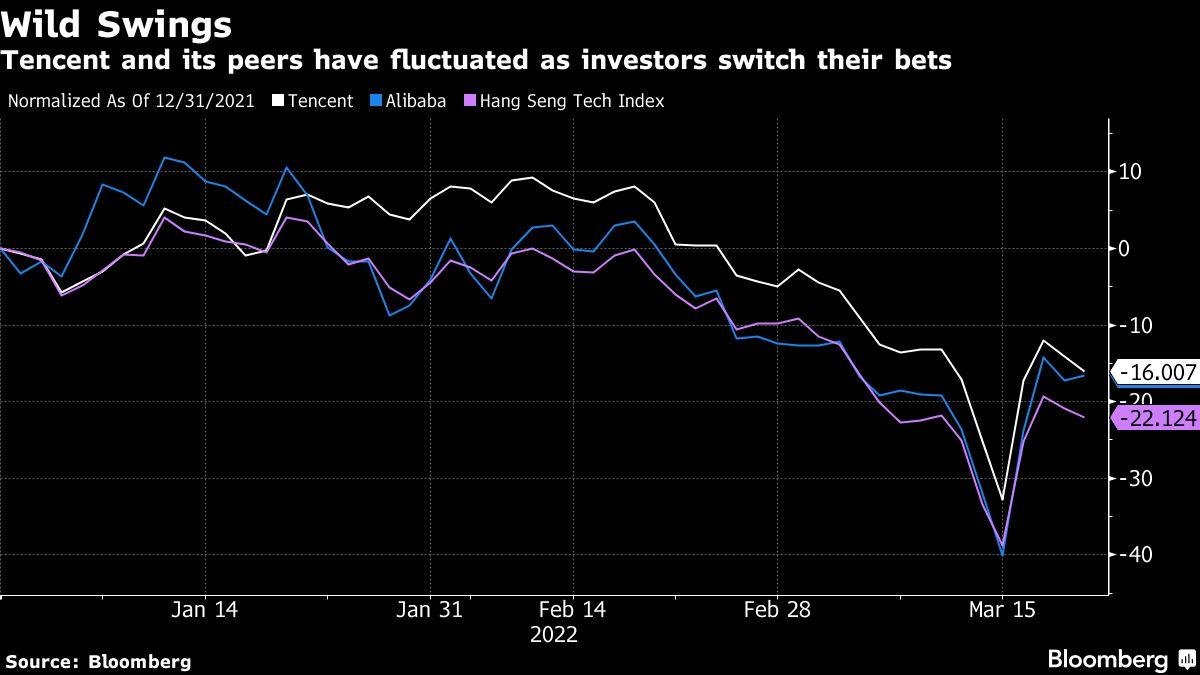

The US isn’t the only country seeing home price inflation:

The increase in home prices has been a “global phenomenon,” Charles Schwab Chief Investment Strategist Liz Ann Sonders wrote in a Twitter post March 28. In fact, 30 out of 60 countries (domestic and emerging markets included), “have been witnessing real house price inflation of >5%,” she added, quoting data from Capital Economics and Refinitiv.

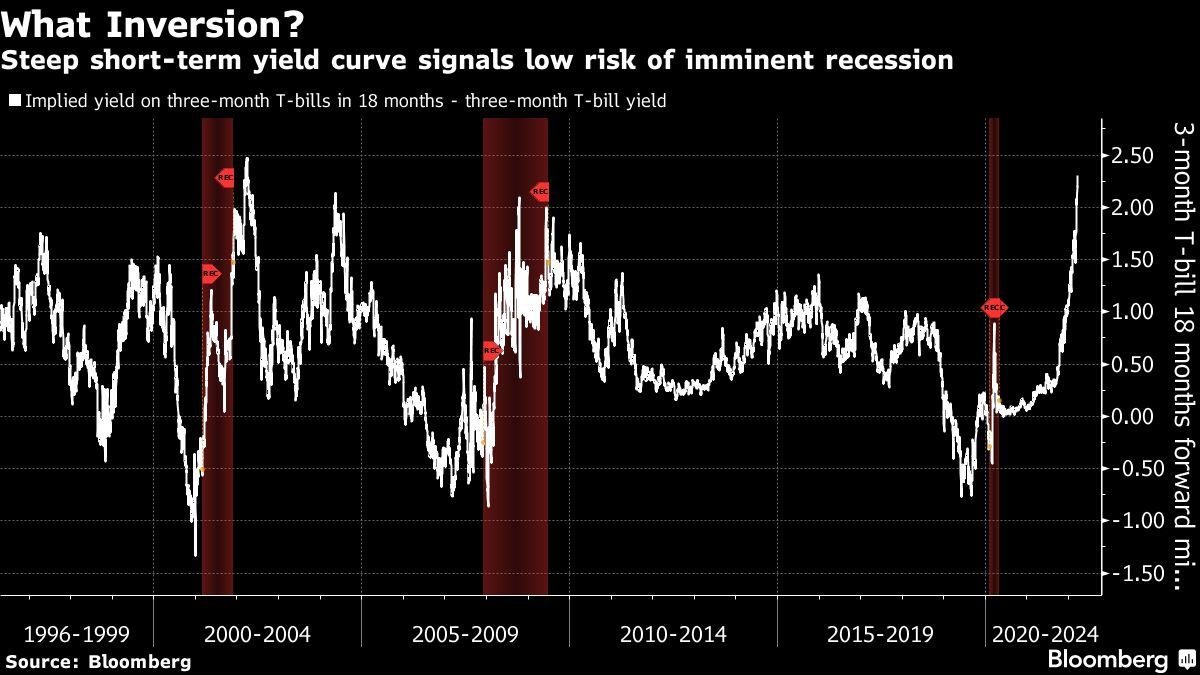

Looking at the worldwide housing boom from a different angle, “the ‘global real house price index’ over the last 50yrs shows the 3 periods where excess easing led to housing bubbles:” First in the late-1980’s driven in Japan, second in early -2000’s driven in US and the European Union, macro analyst Adem Tumerkan wrote in a Twitter post March 30. “Via mean-reversion, home prices will sink eventually,” he added. Meanwhile, bond investors are pricing in the Fed’s transition to tighter monetary policy, with short-term Treasury yields rising rapidly and in some cases jumping above long-term ones in a move that usually precedes a recession or a slowdown in economic growth and inflation expectations .

Homebuilders: DR Horton (DHI), KB Home (KBH), PulteGroup (PHM), Toll Brothers (TOL), Lennar (LEN), Beazer Homes (BZH), Tri Pointe (TPH), Hovnanian Enterprises (HOV), NVR ( NVR), Taylor Morrison (TMHC) and Meritage Homes (MTH).

Apartment REITs: Preferred Apartment (APTS0, Equity Residential (EQR), Independence Realty (IRT), AvalonBay (AVB), Bluerock (BRG), Camden (CPT), Apartment Income (AIRC), Mid-America Apartment (MAA) and Veris (ERV).

At the end of March, mortgage rates surpassed 4.5% to the highest since 2018.

![“Ghosts” recap: season 2, episode 10 – [Spoiler] To kiss](https://nokiamelodileri.com/wp-content/uploads/2022/12/Ghosts-recap-season-2-episode-10-Spoiler-To-kiss.jpg)

![The Walking Dead Recap: Season 11, Episode 23 — [Spoiler] Die?!?](https://nokiamelodileri.com/wp-content/uploads/2022/11/The-Walking-Dead-Recap-Season-11-Episode-23-—-Spoiler.jpg)

![‘She-Hulk’ Recap: Finale Criticizes MCU Tropes, Introduces [Spoiler]](https://nokiamelodileri.com/wp-content/uploads/2022/10/She-Hulk-Recap-Finale-Criticizes-MCU-Tropes-Introduces-Spoiler.jpeg)

![‘I mean, I kinda agree [with] them’](https://nokiamelodileri.com/wp-content/uploads/2022/03/I-mean-I-kinda-agree-with-them.jpeg)

![TikToker Admits He Lied About Jumping That Tesla to Go Viral [UPDATED]](https://nokiamelodileri.com/wp-content/uploads/2022/03/TikToker-Admits-He-Lied-About-Jumping-That-Tesla-to-Go.jpg)

![‘Good Trouble’: [Spoiler] Leaving in Season 4](https://nokiamelodileri.com/wp-content/uploads/2022/03/Good-Trouble-Spoiler-Leaving-in-Season-4.jpg)

![‘The Bachelor’ Recap: Season Finale—Clayton Picks [Spoiler]](https://nokiamelodileri.com/wp-content/uploads/2022/03/The-Bachelor-Recap-Season-Finale—Clayton-Picks-Spoiler.png)

![‘Upload’ Recap: Season 2 Premiere, Episode 1 — Ingrid Is [Spoiler]](https://nokiamelodileri.com/wp-content/uploads/2022/03/Upload-Recap-Season-2-Premiere-Episode-1-—-Ingrid-Is.jpg)

![[VIDEO] ‘The Masked Singer’ Premiere Recap: Season 7, Episode 1](https://nokiamelodileri.com/wp-content/uploads/2022/03/VIDEO-The-Masked-Singer-Premiere-Recap-Season-7-Episode-1.jpg)

![‘The Bachelor’ Recap: Fantasy Suites, Clayton and [Spoiler] break-up](https://nokiamelodileri.com/wp-content/uploads/2022/03/The-Bachelor-Recap-Fantasy-Suites-Clayton-and-Spoiler-break-up.png)

0